The Fall of Japanese Cars from Grace!

Advertisements

The Japanese automobile industry is witnessing a significant decline, particularly highlighted by a recent trend where Chinese automotive exports have surpassed those of Japan for the first time. This shift signifies a historic moment, marking over two decades since Japan held the crown as the leading exporter of vehicles globally. The once formidable trio of Japanese automakers—Toyota, Honda, and Nissan—now finds itself grappling with shrinking market shares and increasing pressure from domestic competitors in China.

The automotive sector has long been a critical pillar of Japan's economy, accounting for about 40% of the country’s total industrial output. It has also provided approximately 5.3 million jobs domestically, representing the apex of Japanese industrial achievement. However, the prominence of the automotive industry appears to be waning as Chinese firms increasingly dominate the market, bringing Japan’s once shining automotive legacy to a precarious point.

To understand the current downfall of Japanese automobiles, one must delve into history, exploring the evolution of the global car industry and its competition. Initially, the most significant rival for Japanese automakers was not China, but rather the United States. During the 1970s, Japanese manufacturers launched a strategic assault on the American automotive space, much like a stealthy attack akin to Pearl Harbor.

At that time, American carmakers, represented by giants such as Ford, flooded the global market, embodying a powerful presence that overshadowed their Japanese counterparts. However, in response to this dominance, Japan began adopting innovative strategies to reclaim market share. The initial focus was on creating smaller, fuel-efficient cars, positioning Japanese vehicles as affordable alternatives in a market that was saturated with larger, high-consumption models from the U.S.

American cars, celebrated for their powerful engines and larger dimensions, posed a distinct allure for consumers. Yet, the downside was stark—these American vehicles were often fuel-inefficient, contributing significantly to environmental problems. As fuel prices soared, so did consumer disillusionment, leading to discontent directed towards the very vehicles they had once favored.

With this backdrop, Japanese manufacturers seized the opportunity to differentiate themselves by investing in smaller, economical cars. They perfected a formula that would soon resonate globally—low prices, reduced fuel costs, and fewer mechanical failures became the cornerstones of Japanese automotive engineering. This strategic pivot enabled Japan to strategically invade markets traditionally dominated by American vehicles, ultimately capturing American consumers in the aftermath of the 1973 oil crisis.

While Japanese manufacturers adeptly expanded into the American market, they didn't stop there—they swiftly turned their attention to Southeast Asia. Recognizing the cost-effective labor and resources in the region, Japanese automakers replicated successful strategies to capture market dominance in Southeast Asia. Their presence in this region was a significant source of revenue, fostering growth while raising the stakes for competition.

In China, Japanese automakers initially thrived on a regional strategy that leveraged the same strengths—affordability and fuel efficiency. This approach won immense favor among Chinese consumers, leading to scenarios where cars like the Honda Civic were in such high demand that potential buyers would wait months to get their hands on one. In fact, even the founder of Geely, Li Shufu, publicly admitted that Chinese automakers looked up to Toyota as a benchmark for excellence.

However, a turn of events occurred around 2010, whereby domestic producers, previously stifled by Japanese automotive might, began to strike back. This shift was partly driven by advancements in technology and a strategic redirection towards electric vehicles (EVs), a sector where Japanese firms were surprisingly slow to react. Despite possessing valuable patents in EV technologies, Japanese manufacturers failed to pivot effectively from their investments in traditional fuel technology, thus missing out on the burgeoning EV market.

Foreign competitors like Tesla emerged, challenging the automotive status quo. While Japan was sitting on a treasure trove of technology, the heavy investments in internal combustion engines and related infrastructure seemingly shackled them to the past. As the world shifted towards sustainable energy solutions, Japanese companies hesitated to abandon their traditional manufacturing models, fearing the loss of past investments and market share.

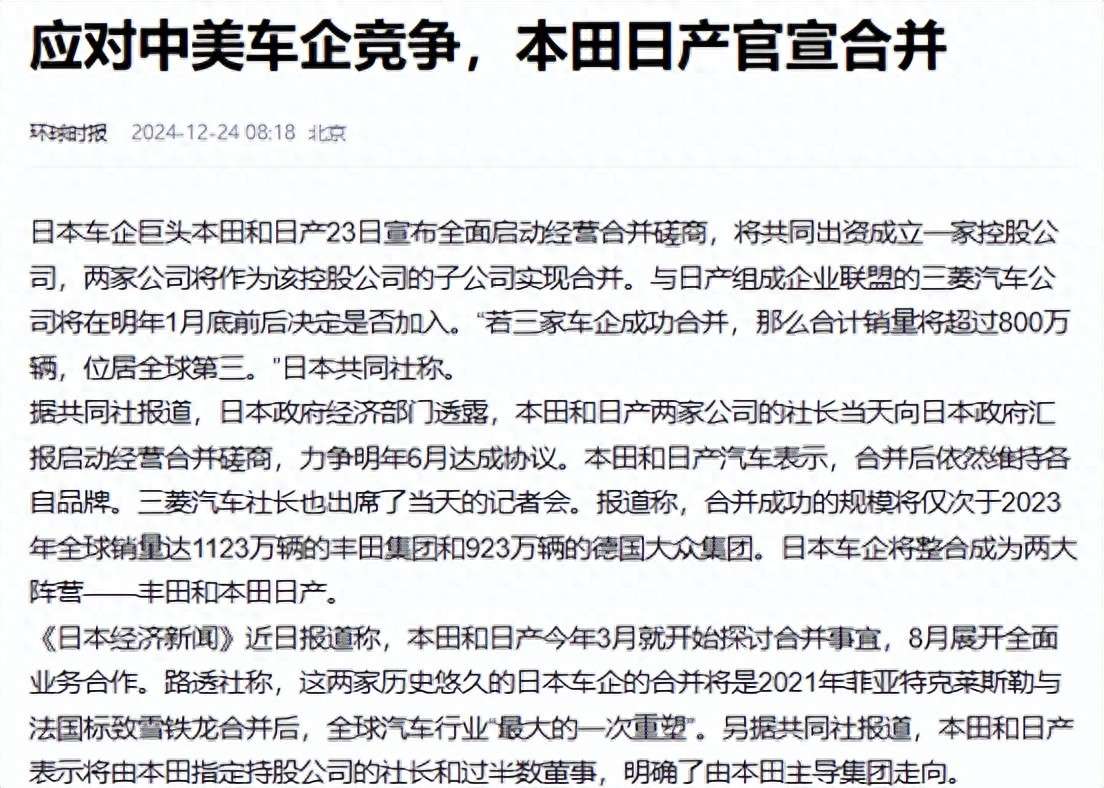

In sharp contrast, Chinese manufacturers adeptly seized their moment, leveraging government support and making significant investments in green technologies to breathe life into their electric vehicle production. Companies like BYD and NIO surged forward, presenting competitive offerings that rivaled anything from Japan's automakers. By 2024, for instance, BYD's market share in China had eclipsed that of the big three Japanese automakers, putting it at the forefront of the new automotive epoch.

The momentum for Chinese electric vehicle producers continued to grow, spilling over into Southeast Asia, where they found competitive advantages against the slowly faltering Japanese brands. Initially, Southeast Asia was an expanse where Japanese automakers had thrived, but they now face fierce competition from Chinese upstarts. Countries like Thailand have seen companies like BYD and Great Wall Motors leading the charge in the transition to electric vehicles, leaving Japanese firms scrambling to respond.

The last few years have been telling, with Chinese brands claiming seven of the top ten bestselling electric vehicles globally in 2022. The repeated mention of Japanese firms as having no representation on this list paints a grim picture for their future. The visibility and dominance they had once enjoyed have diminished remarkably, underscoring a critical transition in the automotive landscape.

In an unexpected twist, Toyota, the venerated giant of Japanese automotive prowess, has sought assistance from Chinese corporations in achieving parity in electric vehicle production. For example, after the lukewarm reception of its first electric vehicle, the BZ4X, Toyota reportedly turned to BYD to help remediate battery and electrical challenges. In a twist emblematic of the changing times, once-majestic brands now look to their former competitors for support, highlighting the shifting dynamics of automotive innovation.

As this tumultuous chapter unfolds, it becomes clear that the automotive industry is witnessing an unprecedented shift. The rivalry that once dominated the narrative between American and Japanese automakers has transformed significantly, with Chinese manufacturers ascending to the forefront of the global market. As the dust begins to settle, all eyes will be on how Japan adapts to this rapidly changing landscape and whether it can reclaim its once-envied status in the automotive world.

Leave your thought here

Your email address will not be published. Required fields are marked *